We do not imply or guarantee that you will make a profit and you agree that our team will not be held responsible for your possible losses. The current ratio is sometimes referred to as the working capital ratio and helps investors understand more about a companys ability to cover its short term debt with its current assets.

Etfs Bullish Usd Vs G10 Currency Basket Securities Fund Ratio

The se! cond step in liquidity analysis is to calculate the companys quick ratio or acid test.

Currency ratio analysis. Current ratio is a measure of liquidity of a company at a certain date. Leveraged trading in foreign currency carries a high level of risks and may not be suitable to everyone. The quick ratio is a more stringent test of liquidity than the current ratio formula.

It looks at how well the company can meet its short term debt obligations without having to sell any of its inventory to do so. Two sources of industry average data as well as financial statement data you can use for free are bizstats and bizminer. These graphs show the breakdowns from oandas books for recent o! pen positions for the major currency pairs.

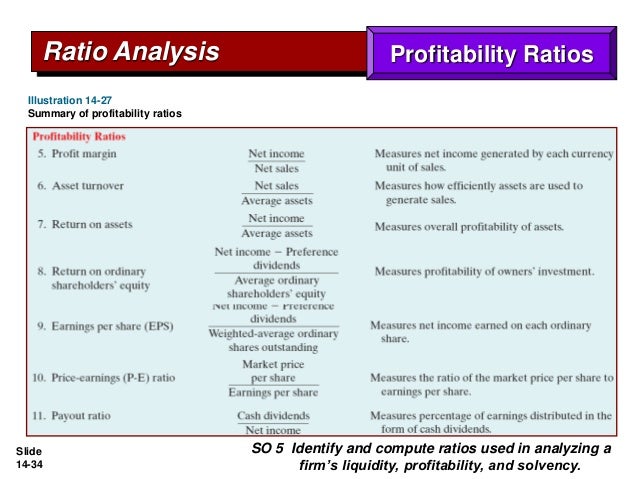

! The current ratio helps investors and creditors understand the liquidity of a company and how easily that company will be able to pay off its current liabilities. Liquidity solvency efficiency profitability equity market prospects investment leverage and coverage. It must be analyzed in the context of the industry the company primarily relates to.

A summary of open fx positions held by oanda clients. Financial ratios are usually split into seven main categories. The econometric results suggest that real income is as theorized negatively related to and a significant determinant of the currency ratio in tanzania.

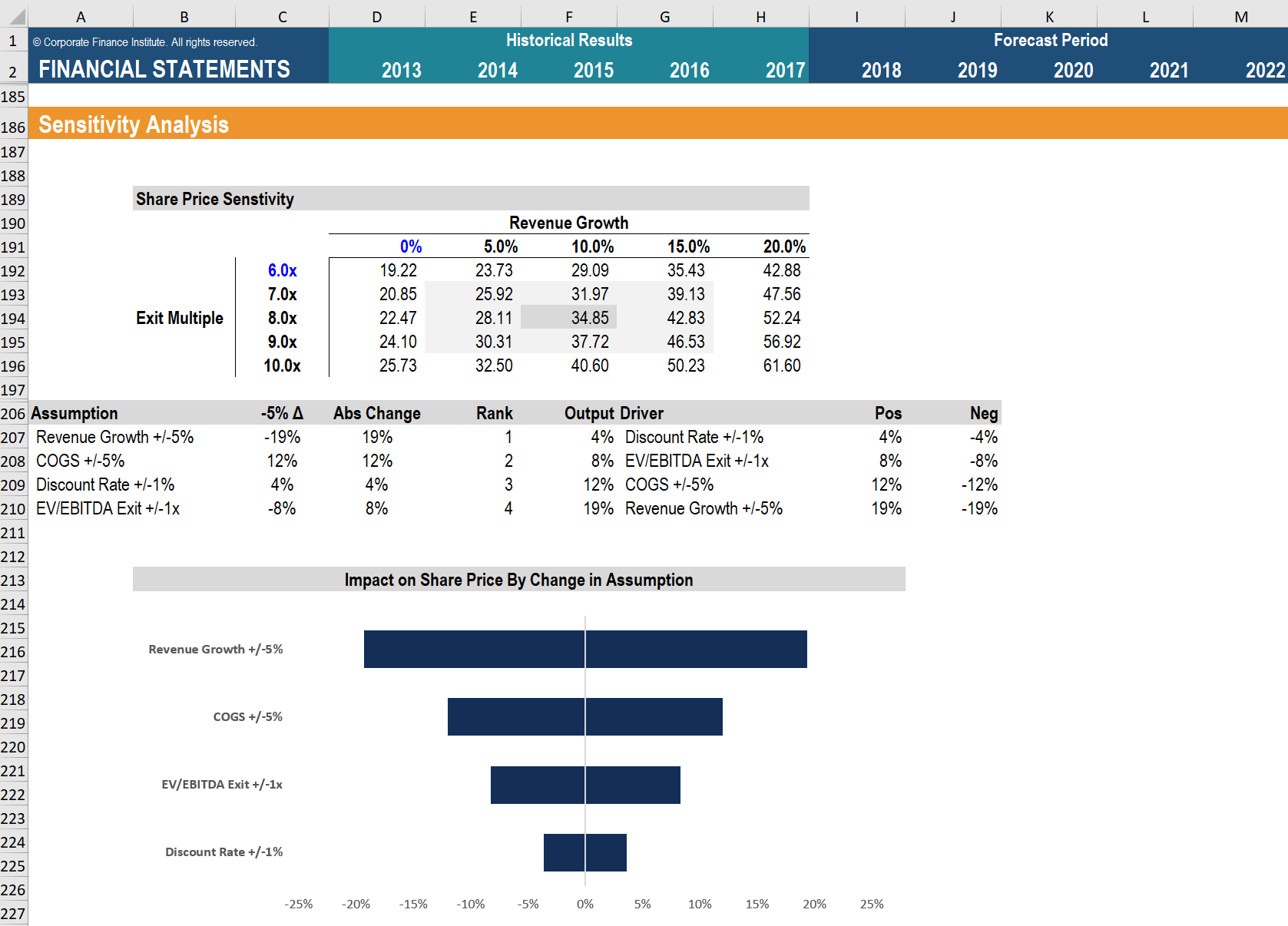

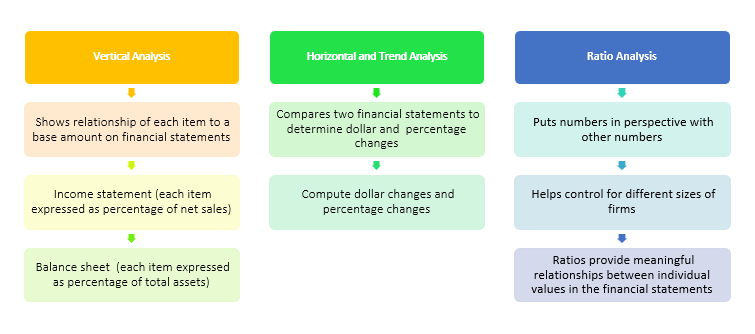

This study tested some key hypotheses on the determinants of the currency ratio in tanzania. As for a limitation of ratio analysis the only limitation is if you use average ratios instead of the ratios of high performance firms in your industry. Ratio analysis can be used to look at trends over time for one company or t! o compare companies within an industry or sector.

Financial ratio analysis compares relationships between financial statement accounts to identify the strengths and weaknesses of a company. Use these to better work your ratio analysis.

Financial Analysis Overview Guide Types Of Financial Analysis

Financial Analysis Overview Guide Types Of Financial Analysis

Variance Decomposition Analysis Percentages Of Deposit Currency

Variance Decomposition Analysis Percentages Of Deposit Currency

Liquidity Ratio Definition Calculation Analysis Video Lesson

Liquidity Ratio Definition Calculation Analysis Video Lesson

Financial Statements And Analysis Techniques General Financial

Financial Statements And Analysis Techniques General Financial

Variance Decomposition Analysis Percentages Of Deposit Currency

Variance Decomposition Analysis Percentages Of Deposit Currency

Currency Risks Hedging Of Commercial Banksa Corporate Clients

Gold To Silver Ratio Analysis Company Newsroom Of Bullion Exchange Llc

Gold To Silver Ratio Analysis Company Newsroom Of Bullion Exchange Llc

The Ultimate Guide To Financial Modeling Best Practices Wall

The Ultimate Guide To Financial Modeling Best Practices Wall

Ratio Analysis Of Financial Statements Formula Types Excel

Ratio Analysis Of Financial Statements Formula Types Excel

Zimbabwe Currency Crisis How The Big Bang Approach Can Work

Best Currency Based On Predictive Analytics 70 Hit Ratio In 3 Days

Best Currency Based On Predictive Analytics 70 Hit Ratio In 3 Days

The Currency Ratio In Tanzania An Econometric Analysis Semantic

The Currency Ratio In Tanzania An Econometric Analysis Semantic

Here S How To Use Cash Flow Ratios To Place Your Bets The Economic

Here S How To Use Cash Flow Ratios To Place Your Bets The Economic

Solved 8 The Reserve Requirement Open Market Operations

Solved 8 The Reserve Requirement Open Market Operations

Ratio Analysis A Summary